Whilst the majority of your clients are likely to be corporate groups or trust structures, at the end of the day, directors and individuals still face solvency challenges. And with the knock-on effect of COVID-19 still not fully felt here in the West, it is likely that we will see a slow increase in insolvency rates as we ‘get back to business’ throughout 2021.

This newsletter article is intended to bring to your attention the changes that have come into force in the personal bankruptcy space as well as some reforms being considered at the Federal Government level.

Bankruptcy Notices

In response to COVID-19, the threshold for an individual to be pursued into bankruptcy was increased from $5,000 to $20,000 and the timeframe for an individual to respond was increased from 21 days to six months. These temporary changes expired on 31 December 2020; however from 1 January 2021, the following revised parameters are in force:

- The statutory period for compliance with a Bankruptcy Notice has reverted to 21 days;

- A new threshold is in force of $10,000 (increased permanently from $5,000).

The change to the debt threshold was introduced following consultation with the insolvency practitioner industry and member bodies, such as the Australian Restructuring Insolvency & Turnaround Association (ARITA), of which we are members at HLB Mann Judd Insolvency WA.

Bankruptcy reforms

The regulation that support the Bankruptcy Act 1966 are due to expire by operation of a sunset provision on 1 April 2021. Accordingly, the Australian Financial Security Authority (AFSA) – the body responsible for the administration of Australia’s personal insolvency regime – is working with the Attorney-General’s Department on a number of minor and technical amendments.

The high level issues are set out below:

- Modernised list of exempt household property a bankrupt is able to retain

- Amendments to certain asset transfers from being void against a Trustee in Bankruptcy

- Determination method of the income of someone claiming to be a dependant

- Information to be entered and held in the National Personal Insolvency Index

- Simplified access in the legislation to monetary figures subject to indexation

- Judgements and proofs of debt in foreign currencies

We will keep you informed of the outcomes as they arise. If you are interested in further detail, you can read the exposure draft here.

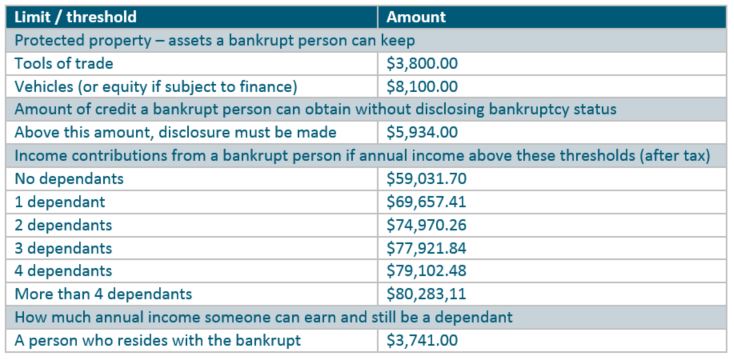

Indexed Amounts

Under the bankruptcy laws, there are a number of monetary value thresholds and limits that are indexed periodically. Set out below are the current amounts for the key limits that we discuss with people facing personal solvency issues:

About the author

Greg Quin is a Partner and Registered Liquidator at HLB Mann Judd Insolvency WA and has been with the team for 12 years. Greg oversees the daily operations of the many insolvency appointments managed by the HLB Insolvency team and looks after the operations of the practice.

If you have any queries about insolvency matters, please feel free to contact Greg on 08 9215 7900, 0402 943 091 or via email to gquin@hlbinsol.com.au.