The Australian economy has faced unprecedented challenges in 2020, with the bushfire crisis at the turn of the year followed by floods and then of course, the COVID-19 pandemic, which continues to wreak havoc, especially in Australia’s two most populous states.

With the national economy taking hit after hit and no respite on the horizon, the Commonwealth Government implemented changes to and enacted new temporary legislation by way of the Coronavirus Economic Response Package Omnibus Act 2020 (Response Act), which came into effect on 25 March 2020.

The intention of the Response Act was to allow for temporary relief to Australian businesses during these unprecedented times.

Key components of the Response Act include, amongst other things:

- The minimum dollar threshold to issue a creditors’ statutory demand increasing from $2,000 to $20,000.

- The deadline for a company to respond to a creditors’ statutory demand increasing from 21 days to six months.

- The minimum dollar threshold for a creditor to initiate bankruptcy proceedings against a debtor increasing from $5,000 to $20,000.

- The deadline for an individual to respond to a creditors’ initiation of bankruptcy proceedings increasing from 21 days to six months.

The temporary legislation introduced as part of the Response Act will remain in effect for six months through to 25 September 2020, however it must be noted that the Commonwealth Government has discretion to extend and/or amend this temporary legislation.

Other initiatives introduced by the Commonwealth Government to provide relief to Australian business included:

- Increasing the instant asset write-off threshold for small businesses (From 23 March 2020 to 31 December 2020).

- ATO relief for tax obligations – including a reduction or deferral of payments and withholding enforcement actions, which include Director Penalty Notices and Winding-Up Applications.

- ATO cash flow ‘boost’ payments (Applicable to the March 2020 and June 2020 quarters).

- Subsidies of 50% for apprentices or trainee’s wages (From 1 January 2020 to 30 September 2020).

- JobKeeper Initiative (Currently in effect through to 28 March 2021).

What does all of this mean for insolvency rates?

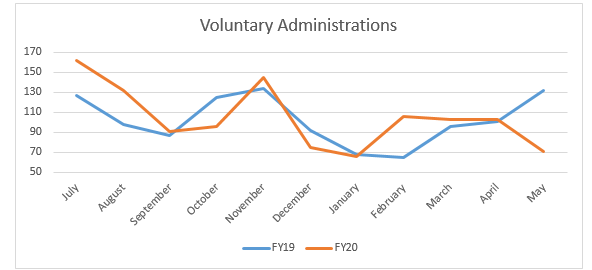

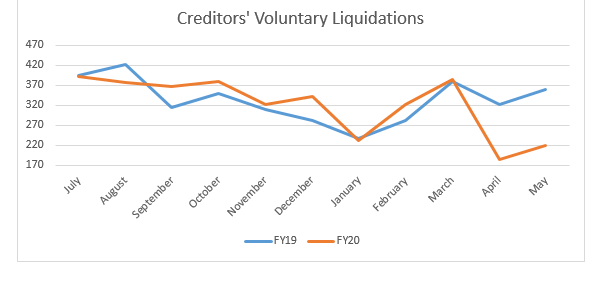

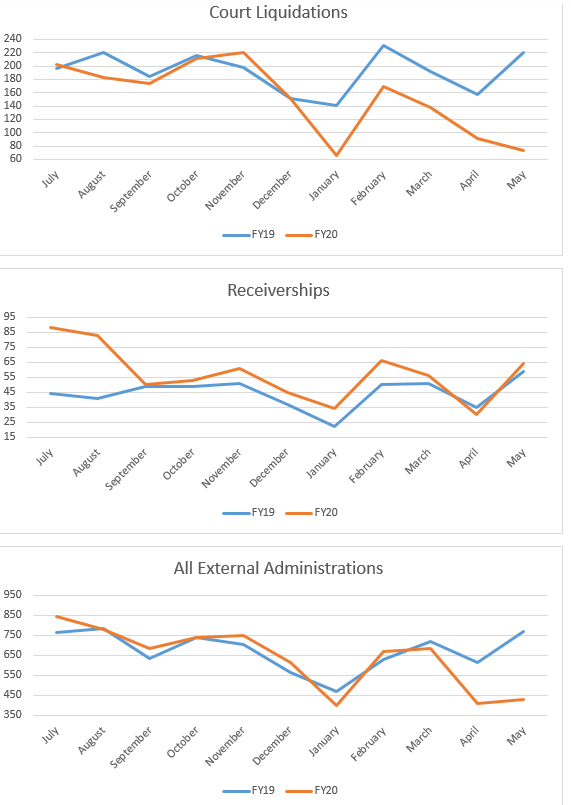

Figures released by the Australian Securities and Investments Commission in July evidence a significant reduction in a number of categories of insolvency appointments since the implementation of the abovementioned Commonwealth Government initiatives.

A comparison of the volume of appointments between FY2019 and FY2020 can be seen below:

The Australian economy has faced unprecedented challenges in 2020, with the bushfire crisis at the turn of the year followed by floods and then of course, the COVID-19 pandemic, which continues to wreak havoc, especially in Australia’s two most populous states.

With the national economy taking hit after hit and no respite on the horizon, the Commonwealth Government implemented changes to and enacted new temporary legislation by way of the Coronavirus Economic Response Package Omnibus Act 2020 (Response Act), which came into effect on 25 March 2020.

The intention of the Response Act was to allow for temporary relief to Australian businesses during these unprecedented times.

Key components of the Response Act include, amongst other things:

- The minimum dollar threshold to issue a creditors’ statutory demand increasing from $2,000 to $20,000.

- The deadline for a company to respond to a creditors’ statutory demand increasing from 21 days to six months.

- The minimum dollar threshold for a creditor to initiate bankruptcy proceedings against a debtor increasing from $5,000 to $20,000.

- The deadline for an individual to respond to a creditors’ initiation of bankruptcy proceedings increasing from 21 days to six months.

The temporary legislation introduced as part of the Response Act will remain in effect for six months through to 25 September 2020, however it must be noted that the Commonwealth Government has discretion to extend and/or amend this temporary legislation.

Other initiatives introduced by the Commonwealth Government to provide relief to Australian business included:

- Increasing the instant asset write-off threshold for small businesses (From 23 March 2020 to 31 December 2020).

- ATO relief for tax obligations – including a reduction or deferral of payments and withholding enforcement actions, which include Director Penalty Notices and Winding-Up Applications.

- ATO cash flow ‘boost’ payments (Applicable to the March 2020 and June 2020 quarters).

- Subsidies of 50% for apprentices or trainee’s wages (From 1 January 2020 to 30 September 2020).

- JobKeeper Initiative (Currently in effect through to 28 March 2021).

What does all of this mean for insolvency rates?

Figures released by the Australian Securities and Investments Commission in July evidence a significant reduction in a number of categories of insolvency appointments since the implementation of the abovementioned Commonwealth Government initiatives.

A comparison of the volume of appointments between FY2019 and FY2020 can be seen below:

Following the implementation of the Commonwealth Government Initiatives on 25 March 2020, the months of April and May saw a decrease in all external administrations of 33% and 44% when compared to the same periods in FY2019 respectively.

The reduction in the total number of external administrations evidences that the Commonwealth Government Initiatives introduced in the first half of 2020 achieved what they were intended to do, which was to prevent a wave of business insolvencies or an ‘Insolvency Tsunami’.

This, however, has created a false economy of sorts, as businesses, sometimes referred to as ‘Zombie Companies’, which would have failed in the ordinary course of business, have remained in operation solely as a result of the support provided by the various Commonwealth Government Initiatives.

In turn, one must be cognisant of the fact that once the Commonwealth Government Initiatives are inevitably scaled back, these ‘Zombie Companies’ and many other struggling businesses will reach a point were external administration is the only option on the table.

When this day comes, the ‘Insolvency Tsunami’ which the Commonwealth Government attempted to avoid with the implementation of the Response Act and other initiatives in the first half of 2020, is likely to come to fruition.

The question for Insolvency Practitioners like us then is what the landscape will look like when this time does in fact come?

Will the auction market be flooded with a large number of similar plant and equipment, therefore driving auction prices down as supply outweighs demand, therefore limiting potential asset recoveries?

Will cash reserves and other assets which companies may have held pre-COVID-19 be exhausted by the time an Insolvency Practitioner is approached, meaning voluntary appointments will be turned away because the Insolvency Practitioner has no way of being paid? This may sound selfish – and although we love our work, we like to be fairly paid for it.

What is the likelihood of voidable transactions actually being recoverable, with the implications of COVID-19 further complicating any potential claims process?

The way in which Insolvency Practitioners determine whether or not to consent to act upon potential appointments will be largely different to what it was just nine months ago, however, it is a change that is likely to remain for the coming years as the economy, not just in Australia, but globally, recovers from the COVID-19 pandemic and the economic impact it has left.

About the author

Benjamin Mitchell is a Senior Insolvency Accountant at HLB Mann Judd Insolvency WA. Benjamin assists the Principal and Director with the many Corporate and Personal insolvency appointments managed by the HLB Insolvency team.

If you have any queries about insolvency matters, please feel free to contact the team on 08 9215 7900.